Research by Beacon Pathway, Te Herenga Waka – Victoria University of Wellington (VUW) and ANZ reveals synergies between building, lending and how a home performs that present opportunities for banks and their customers.

Beacon Pathway led the research project, along with ANZ Bank New Zealand Ltd (ANZ), two researchers from Te Herenga Waka – Victoria University of Wellington (VUW), and two independent new-build performance advisors.

The final report is called “Supporting bank customers to build more comfortable and efficient homes”, and was funded by the BRANZ Building Research Levy.

The aim of the research was to explore the impact of a bank introducing their home loan customers to independent new-build advisors. We were curious how that would help customers along their build journey.

We connected ANZ’s home loan customers with expert advisors who offered personalised advice on how they could design and build a more comfortable and efficient home.

Comfortable and efficient = good home performance: Our homes have a job to do – they must look after us through all our stages of life, in sickness and in health. In this project, we used ‘home performance’ to mean a home that is doing its job well by providing a healthy environment for its occupants while having minimal environmental impact. However, when engaging with bank customers we described this as designing and building a home to be more ‘comfortable and efficient’.

Background to our research

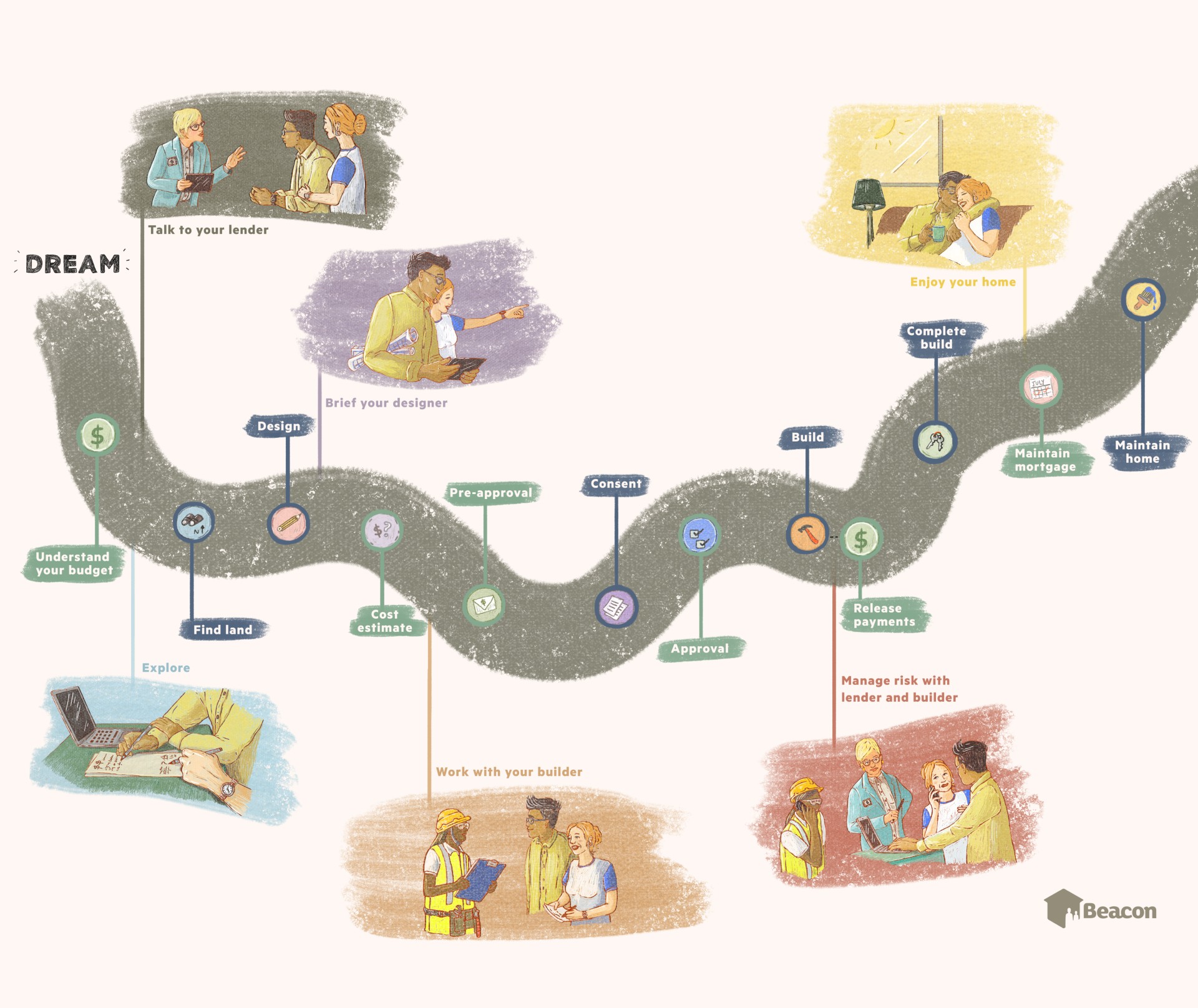

The research, which was conducted between December 2022 and September 2024, was grounded in the project partners’ shared understanding that people building a new home in Aotearoa navigate a lot of complexity. This is particularly so if building with comfort and efficiency in mind.

Personalised advice that meets people wherever they are on their journey has been shown to be effective in enabling people to navigate this complexity. Most people have a relationship with a bank, so we considered banks could be well-placed to facilitate accessing that advice.

We drew on insights from the Waitākere NOW Home experience which tells us there’s a gap between the great job this home does – built back in 2005 – and the status quo.

To help customers benefit from our experience we adopted two principles:

- That early considered design can result in significant improvements to home performance with little, if any, increase in budget (e.g. by considering building size, orientation, size and placement of windows).

- That customers may make a number of informed trade-offs resulting in better performance if they are supported and enabled to do so.

“We saw there were some really nice synergies between the trade-offs and decisions an individual is making as part of drawing up their plans or considering where to buy land, and […] correlating intervention points with your bank.”

ANZ Bank project team member

What we did

The project partners collaborated to co-create and trial an ‘intervention’, or set of activities designed to create change in behaviour patterns.

For this research, the intervention centred around seeing if ANZ home loan customers, who were building new homes, might change their design plans based on advice from the new-build performance advisor.

What we discovered

Our examination of a customer’s building and lending journey highlighted synergies that present opportunities for both banks and their customers.

These opportunities are more than providing information or offering a particular product (although it may include these things). Rather, it provides a framework for a bank to engage with and support customers through the whole process, recognising the benefits of early engagement.

Findings around new-build home loan customers

- Participants thought the bank, as a neutral third party, was well-positioned to connect them to an independent advisor, and this lowered the risk for both parties.

- Trial participants felt ill-equipped for their building journey – they recognised they didn’t necessarily even know what questions to ask.

- The personalised advice participants received as part of the project filled a gap in their understanding they had not been able to fill elsewhere.

Banks and the building sector

- Banks have strong incentives to support their customers to build more comfortable and efficient homes, such as their strategic Environmental, Social, Governance (ESG) objectives, and new obligations as Climate Reporting Entities. We consider there may be benefits here in banks referring customer to an advisor.

- As lenders, banks play a critical role in Aotearoa’s housing eco-system, and can provide leadership to influence its sustainability performance, and consequently the health of occupants.

How banks could support their customers

- Identify customers contemplating building and engage with them early about optimising performance in their designs.

- Upskill bank staff to have more informed conversations with customers about the benefits of considering performance early in their planning.

- Explore a range of incentives and other benefits banks could offer customers for building a more comfortable and efficient home.

- These may range from offering financial incentives if customers build to a certain benchmark (e.g. ANZ’s Healthy Home Loan that requires Homestar 6+) to other less formalised approaches, such as referring customers to a new-build advisor.

- Create an interactive building-lending journey map that sets out the roles of different parties and optimal timing for different decisions, then link customers to other resources and services.

Potential in existing homes

The scope of this research was bank customers borrowing to build a new home. However, the project partners, including our funder, BRANZ, recognise the potential to create benefits at a larger scale by applying these insights to the existing home market.

This research could help by:

- integrating comfort and efficiency into a bank’s engagement with its customers when buying or renovating existing homes

- referring customers to independent experts to give personalised advice – this may be particularly useful for banks offering low-interest top-up mortgages on existing homes.

Advice sector in Aotearoa

The research reinforced the value of personalised advice that meets people wherever they are on their journey to build a home that works for them. It also indicated there is likely to be value in banks referring their customers to an independent advisor who can support them on that journey.

However, at present the advice sector in Aotearoa is not well-established enough to meet the requirements of banks keen to take up this opportunity.

Beacon is undertaking further research into the advice sector, including the operating requirements for it to respond to future demand.

Waitākere NOW Home

For more, see the Waitākere NOW Home. Built in 2005, this home showed that considered design makes it possible to build a new home on a modest budget with existing materials and technology that is warmer in winter, cooler in summer, and cheaper to run than an average home.

Download the report:

Research Partners